Saving money, investing wisely, and achieving financial goals can feel like an uphill battle, especially in today’s fast-paced world. Between bills, unexpected expenses, and the constant temptation of spending, it’s easy to fall behind. But what if your money could work smarter, not harder, alongside you?

That’s where artificial intelligence (AI) comes in.

AI tools are transforming personal finance by helping people automate, optimize, and plan in ways that were once time-consuming or nearly impossible. From personalized budgeting advice to predictive investment insights, AI can give you a roadmap to reach your goals faster — often without adding stress to your day.

What Does AI in Personal Finance Do?

At a basic level, AI in personal finance learns from your spending habits, income patterns, and financial behavior. By analyzing this data, AI can suggest practical steps for saving, investing, or paying off debt.

Unlike static budgeting apps, AI can adapt in real time. For example, if you unexpectedly spend more on groceries this month, your AI tool might recommend slightly reducing discretionary spending elsewhere, keeping your overall financial plan on track. Over time, this continuous guidance helps prevent small oversights from becoming major setbacks.

Personalized Budgeting and Spending Insights

AI can do more than track expenses; it can understand patterns. Modern AI apps categorize transactions automatically, highlight unusual spending, and even predict future expenses based on historical trends.

For instance, some AI platforms can warn you that your electricity bill usually spikes in December, prompting you to budget ahead. Others might notice that you frequently dine out on Fridays and suggest a small adjustment if saving for a specific goal. These insights are highly personalized, helping you make smarter decisions without the need to constantly analyze spreadsheets.

AI-Powered Goal Tracking and Automation

One of the most effective ways AI helps people reach financial goals faster is through automation. AI can automatically allocate money toward savings, investments, or debt repayment without requiring constant manual intervention.

Take, for example, automated savings platforms that transfer small amounts to a savings account whenever you have excess funds. AI determines the optimal amount you can safely save while maintaining your daily spending needs. Over time, these micro-savings can add up to significant amounts, keeping your financial goals on schedule.

Some AI platforms even suggest automated investment strategies, optimizing your portfolio based on risk tolerance and time horizon. By combining automation with smart decision-making, AI removes many of the human errors and procrastination factors that delay goal achievement.

Investment Optimization with AI

Investing is often the fastest way to grow wealth, but it can be intimidating. AI simplifies this process. Robo-advisors analyze market trends, predict potential returns, and suggest diversified portfolios tailored to individual risk profiles.

For example, platforms like Wealthfront and Betterment use AI algorithms to rebalance investments automatically and reinvest dividends. This approach ensures your money is always working efficiently toward your long-term goals, even if you’re not actively monitoring the market every day.

AI also provides insights into tax optimization. Some platforms can minimize capital gains taxes automatically, ensuring more of your money stays invested and grows over time.

Predictive Insights for Smart Decision-Making

AI can anticipate financial challenges before they occur. For instance, predictive analytics can alert you if your projected spending for the month will exceed income, suggesting adjustments proactively.

In more advanced applications, AI can forecast market trends, inflation impacts, or upcoming changes in subscription costs. This foresight allows users to make informed choices rather than reacting after the fact, accelerating the path to their financial goals.

Real-World Examples of AI in Action

Consider a young professional saving for a down payment on a house. Using an AI-driven app, they receive weekly insights on spending, automatic transfers to savings, and reminders for irregular expenses like car insurance or annual taxes. By the end of the year, the combination of automation and predictive guidance has grown their savings faster than traditional methods.

Another example is debt repayment. AI tools can recommend which loans to prioritize based on interest rates and remaining balances, automating payments to minimize interest while keeping cash flow manageable. This ensures financial goals like becoming debt-free are reached faster with less mental effort.

Benefits of Using AI to Reach Financial Goals Faster

AI offers three main advantages:

1. Time Efficiency: By automating repetitive tasks like savings transfers, bill payments, and portfolio rebalancing, AI frees users from manual oversight.

2. Personalized Guidance: AI adapts to your financial behavior, providing insights and recommendations specific to your situation rather than one-size-fits-all advice.

3. Improved Consistency: Regular guidance and automated actions help maintain consistent progress toward goals, preventing lapses caused by human forgetfulness or procrastination.

Together, these benefits can shave months or even years off your timeline to achieve key financial milestones.

Risks and Considerations

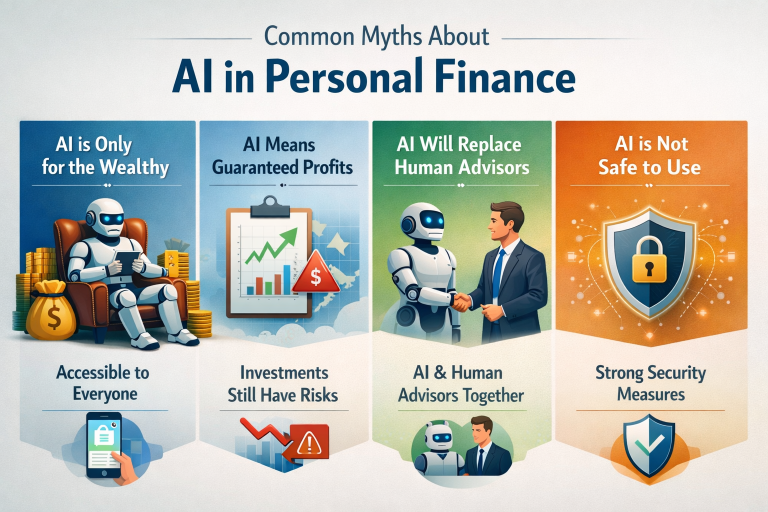

AI is a tool, not a guarantee. Predictions are based on data and historical patterns, which may not always reflect future conditions. Unexpected expenses, market volatility, or changes in income can impact outcomes despite AI guidance.

Privacy is another important consideration. Ensure any AI tool you use encrypts your financial data and follows strict security protocols. Avoid platforms that require sharing sensitive passwords or full access to bank accounts unnecessarily.

How to Get Started with AI for Financial Goals

Start by identifying your key objectives: are you saving for retirement, a home, or paying off debt? Choose an AI tool that aligns with your goals, whether that’s an automated savings app, a robo-advisor, or a comprehensive personal finance AI platform.

Enable notifications and review AI recommendations regularly. Treat the tool as a coach, not a replacement for your judgment. Gradually expand your use of automation and analytics as confidence grows.

For beginners, starting with savings automation is often the simplest and safest way to experience measurable results.

The Future of AI in Personal Finance

AI in finance is only getting smarter. Future developments include voice-activated AI financial assistants, deeper integration with banking systems, and more predictive analytics that can guide you toward smarter investment and savings strategies.

Imagine an AI system that monitors all accounts, investments, and recurring bills, then offers a daily briefing of opportunities and risks, all in plain language. That level of automation and insight could redefine how people achieve financial independence.

Final Thoughts

Artificial intelligence is no longer just a futuristic concept; it’s a practical tool for anyone looking to reach financial goals faster. From personalized budgeting and automated savings to predictive investment guidance, AI streamlines decision-making, reduces errors, and keeps progress consistent.

The key is to use AI thoughtfully: start small, maintain oversight, and combine automation with strategic planning. When leveraged correctly, AI doesn’t just make managing money easier — it accelerates the path to achieving your dreams.

Frequently Asked Questions

1. How can AI help me reach my financial goals faster?

AI analyzes your spending, income, and habits to provide personalized advice and automate savings or investments. It helps you make smarter financial decisions consistently.

2. Do I need technical skills to use AI financial tools?

No. Most AI budgeting, savings, and investment apps are designed for non-technical users with intuitive dashboards.

3. Can AI predict my future financial needs?

AI can forecast trends and upcoming expenses based on historical patterns but cannot guarantee exact predictions. It’s best used for planning and risk awareness.

4. Is it safe to connect my bank accounts to AI tools?

Yes, reputable platforms encrypt your data and follow strict security standards. Always enable two-factor authentication and avoid apps requiring full withdrawal permissions.

5. Will AI replace my financial advisor?

AI supplements advice by automating tasks and providing insights but does not replace human judgment. It works best alongside professional guidance or personal planning.

Further Reading

- Consumer Financial Protection Bureau (CFPB) – Guidance on digital financial tools and consumer protection

https://www.consumerfinance.gov - Federal Reserve Board – Research on digital payments and personal finance innovation

https://www.federalreserve.gov - National Institute of Standards and Technology (NIST) – AI and data security standards

https://www.nist.gov